What are inactive institutions in Peer-to-Peer

Within Peer-to-Peer, you have the ability to analyze inactive institutions, referring to institutions that no longer exist either through mergers or liquidations. Institutions that have changed their names or charter number are not considered inactive. You can recognize inactive institutions by a dagger superscript and the month and year in which the institution last reported next to the name.

How to enable inactive institutions

The first step to analyzing inactive institutions in Peer-to-Peer is to enable inactive institutions. The default option is to not have inactive institutions turned on, so to active them, go to the settings menu in the upper right corner of the screen. Then, select ‘Inactive institutions’ and choose ‘Enable access to inactive institutions’ and save.

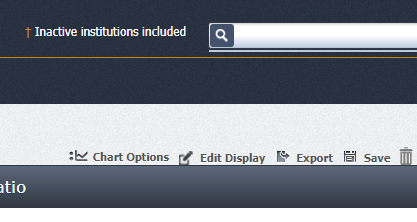

When you have completed that, an indication will come up next to your search bar so you know you have inactive institutions included:

When this option is enabled, Peer-to-Peer will allow you to analyze institutions that were active in the past, instead of including only the institutions that are active in the current cycle. When you change your cycle at the top to a time when the inactive institution was still active, you can search for that institution or include it in peer group analysis.

How to create a peer group using inactive institutions

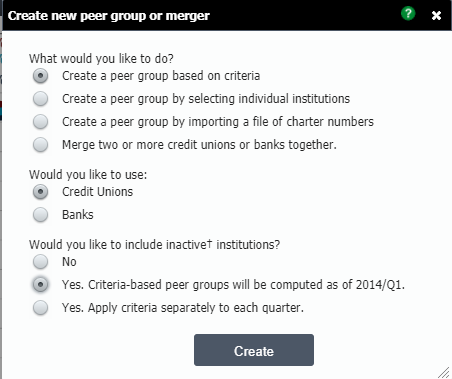

Once you have enabled inactive institutions, you have the options to include inactive institutions in your custom peer groups peer groups. To do this, first set the cycle to the quarter you would like to analyze. The key to successfully including the correct inactive institutions is ensuring that your peer-to-peer account is in the right cycle when you create your peer group. For example, if you wish to analyze an institution that was active in the first quarter of 2014 but is now inactive, you must set your cycle to the first quarter of 2014 prior to creating the peer group.

Next, go to Comparison Set in the upper left corner of your screen and click create new. This will bring up your “create new peer group or merger” dialogue box. If you would like to include inactive institutions scroll to the bottom of the box and select ‘Yes, criteria-based peer groups will be computed as of [the cycle you’re in].’

Now you can create your peer group based on criteria, importing charter numbers, selecting individual institutions, or create a merger. For more information on custom peer group builds, click here.

Analyzing data with inactive institutions

Analyzing data using inactive institutions allows you to see the industry as it was at that point in time. Peer-to-Peer offers a built in peer group called “All CUs that ever existed” which allows you to cycle back in time to analyze all credit union chartered, going back to the first quarter of 1998. As you cycle throughout different quarters you will see your peer group change in size to reflect the number of active institutions. This will allow you to not only see the industry as a whole at different points in time, but give you a perspective on credit union performance that may be masked by not including inactive institutions.