Jump Into Analytics

As a Callahan & Associates’ client, you have access to a set of our analytics resources designed to help credit union industry professionals like you do their jobs better.

In this section, you can learn:

-

What solutions each of our analytical tools can help you with

-

How to log in, manage users, and act as an admin

If you’re not sure what you have access to, please reach out to our support team.

There are several options to pick from when selecting which analytical tool is right for your performance analysis needs. To help you pick the best resource for your needs, review the main features, applications, and included data for each. While one tool might fit your needs today, we encourage you to log in and familiarize yourself with all four resources for future projects that might arise.

Peer-to-Peer is our most in-depth financial analysis and benchmarking resource that helps you accurately and quickly compare a credit union’s performance against relevant peers, including banks. With customization that allows you to pull any account code recorded on the 5300 call report for peer group creation or report building, your analysis options are endless.

Included data:

- 5300 call report data (dating back to 1998)

- FDIC Bank (dating back to 2005)

- Econometric data

- Return-of-the-Member (ROM) scoring system

- CUPP scoring

- Vendor data (core processors, home banking, auditor, and more!)

CUAnalyzer is an educational resource that allows you to quickly analyze performance in key financial and operational areas. Unlike Peer-to-Peer which requires more of a working knowledge of the 5300 call report, CUAnalyzer is ideal for professionals looking to learn more about particular performance ratios and identify areas of strengths and weaknesses quickly.

Included data:

- 5300 call report data (dating back 5 years)

- Return-of-the-Member (ROM) scoring system

BranchAnalyzer is a deposit market share analysis tool that helps you track deposit performance at the branch, institution, and market level.

Included data:

- FDIC Deposit data (for bank branches)

- S. Census data

- 5300 call report data (deposits for credit unions are an average of total deposits/number of branches)

MortgageAnalyzer is a mortgage market share analysis tool that allows you to quickly identify market leaders and analyze your credit union’s position against credit unions, banks, mortgage CUSOs, and other mortgage lenders.

Included data:

- Home Mortgage Disclosure Act (HMDA) data

Access & Registration

How to Log In?

The username and password you entered to access this site can be used to enter your Client Portal, which has links to all the resources outlined on this page.

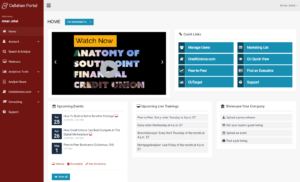

We recommend you start your journey via the Callahan Client Portal (shown at right), which you can do via Callahan.com or CreditUnions.com.

Your login credentials also work to access CreditUnions.com, which is the editorial wing of Callahan & Associates.

To reset your password, follow the steps below, based on whether you’re already logged in to your Client Portal:

- You are already logged into your client portal or CreditUnions.com, but can’t remember your password or want to reset it for other reasons. To do so, either click your name in the upper right hand corner and then “My Account” or click “Account” in the left hand navigation and then “My Profile”. Underneath the information listed in the “My Account Info” tab there is a button, “Reset Password”. Click this and follow the directions to change your password.

- You’re locked out! To get this situation fixed as quickly as possible, simply click here and submit your email address to retrieve your password. To do this, you need to be logged out of CreditUnions.com

As a reminder, although these steps take place on CreditUnions.com, that is because CreditUnions.com is a Callahan & Associates resource. Your login email and password will be identical for both.

Your account administrator (note: there may be several) can set up any coworkers you wish with access. Your Callahan partnership is enterprise-wide and comes with unlimited user logins.

Company admins are the only users with manage user privileges, which allow them to add, edit, or remove user access. Please read the article linked below for full instructions on how managing users works.

If you don’t know who your company admin is or your account manager from Callahan & Associates, please email the Callahan Support Team and they will get back to you as soon as possible.

Company administrators help ensure your team’s information and user list is as up-to-date as possible.

Company admins have the ability to:

- Manage users (Add, edit, and deactivate).

- Update user and company-level contact information.

- Upload a company logo.

- Upload 5300 call report for early access.

- Edit branch deposit data in BranchAnalyzer

user_email; $date = new DateTime(); $key = InterfaceString($uemail2, $date); $cualink=’http://cuanalyzer.com/passthru.htm?username=’.$uemail2.’&link=’.$key; $peerlink=’http://cloud.p2psoftware.com/passthru.htm?username=’.$uemail2.’&link=’.$key; $balink=’http://www.branchanalyzer.com/home/Redirected?id=’.$key.’&email=’.$uemail2; $malink=’http://mortgage.p2psoftware.com/MAPeerLogin.aspx?Pkey=’.$key.’&email=’.$uemail2;

/********************* DO NOT EDIT ABOVE THIS LINE ****************/ ?>